Beneficial ownership arrangement in Migration Law

News Redd Lei Published 08 July 2022 Edited 08 July 2022

The net asset requirement in Australian business migration generally concerns the net value of the asset, the source of the assets and the ownership of the assets. Often this requirement is not arguable. However, things may become complicated if the net asset claimed is a property registered under the applicants’ children’s name. Some applicants may also have the issue that their assets were sourced from dividend but they entrusted someone else to hold the shares in the company. People may have the misconceptions that they are unable to claim the ownership of these assets because they were not the legal owner. Indeed, issues in this regard have been properly dealt with in Australian migration law, and there is arrangement of this particular type of ownership-beneficial ownership. In general, people having beneficial ownership can still enjoy the benefits of the asset even though the title is under other persons’ names.

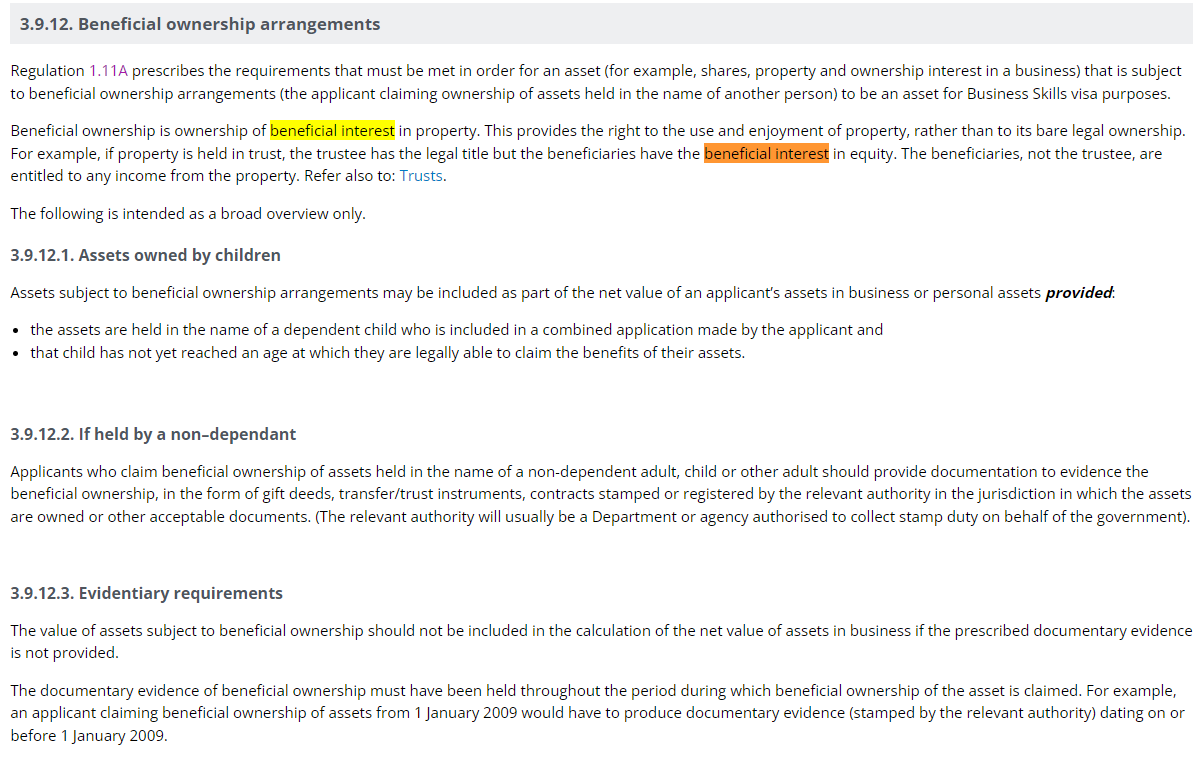

Reg 1.11A of Migration Regulation 1994 (Cth) is the provision concerning this arrangement. Even if the applicant is from the country where equity is not applicable, applicant can still rely on this provision to claim the ownership of the asset. It must also be noted that, to corroborate such ownership, this provision also imposes the qualifications of the evidence. Inter alia, applicant should note that notwithstanding reg 1.11A(2)(c) allows a broad range of documents, the stamping or registration requirement is required. This will be particularly difficult where family members have concluded a written domestic agreement as to some assets but the legal system in that country does not provide stamping or registration procedure.

Noteworthy, reg 1.11A(4) dispenses the evidence requirements if the asset is held by dependent child. However, the child must satisfy dependency requirement, age requirement and the child must apply with the parents.

Procedures Advice Manual also emphasises that if the asset is held by a non-dependant, the evidence requirements are in place.

Applicants are therefore encouraged to review their assets in more great details because you may find that you are able to claim the beneficial ownership of certain assets that you never realised. Afterwards, applicants are strongly recommended to ascertain whether the evidence requirements can be satisfied or perfected, for which consulting the legal practitioner in that particular country is more prudent and sensible. The applicant is also encouraged to engage an Australian Legal Practitioner or Registered Migration Agent to verify whether this requirement is satisfied.

Longton Legal has extensive experiences in dealing with the issues in this regard. If you have any questions regarding the above, please feel free to contact us.

*Disclaimer: This is intended as general information only and not to be construed as legal advice. The above information is subject to changes over time. You should always seek professional advice beforetaking any course of action.*

Key Contacts

Alexander Kaufman

Partner

Redd Lei

Lawyer

Further reading